How Does A CFO Add Value?

Streamline your financial strategy and set goals that will move your company forward with our Accounting and Acting CFO Services.

We have extensive experience serving as acting CFOs for defined periods of time, providing our clients with senior-level guidance without the need or expense to hire a new member of the management team. Our acting CFOs provide strategic financial guidance to the CEO on such matters as fundraising, M&A transactions, contract negotiations, relationships with investors, bankers, auditors, as well as preparing for board meetings.

You may ask, “How will a CFO add value?” Well, there are a number of ways in which a CFO can help you achieve your financial goals.

The Role of a CFO

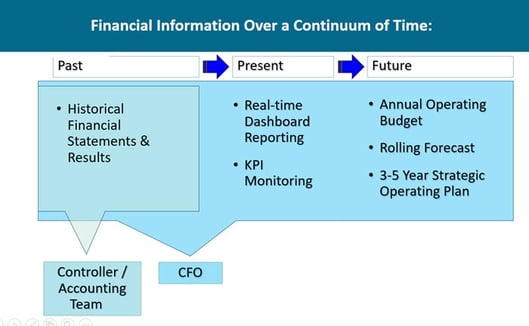

While the controller/accountant lives in the past; the CFO lives in the past, present and future. An accountant manages data. The controller produces financial statements, possibly offers some analysis and implements controls. The CFO lives in the present, looks to the future, and helps lead the organization. In the Present – monitors key performance indicators using dashboard reporting and monitoring cash. In the Future – develops an annual budget, a rolling forecast, a 3 to 5-year strategic operating plan.

How a CFO Adds Value

A good CFO will find ways to improve cash flow, profitability, and the balance sheet to cover the added cost of a CFO and then some. Controlling costs, improving productivity, and analyzing pricing strategies are a few ways a CFO improves profitability.

Cash Management

A CFO will put an effective cash management system in place. By managing the cash cycle, the company improves collections, pricing, and terms; all adding to increased liquidity. This includes managing capital, debt obligations, and ensures the ability to invest in new projects. Cash flow projections prepared by the CFO provide a means for the management of cash, which is the lifeblood of a company.

Leadership

Sales and operations departments often distance themselves from company finances or financial strategies but an effective CFO brings financial insights and leadership to help the company maximize profits by increasing cash flow and minimizing costs.

Liaison

A CFO brings credibility with finance-based professionals and may act as a liaison with the bank to secure funding. A CFO adds value by bringing knowledge when deciding on financing, leasing or purchasing. They provide knowledge around issues like the advantages of operational expenditures over capital expenditures. This means a stronger position when negotiating with vendors.

Exit Strategy

A CFO will know what steps are required to develop long term exit strategies and succession plans that fit the company goals and circumstances. They help to prepare a company by having defensible financials and a logical strategy before an interested party is available. If needed, a CFO can:

<> Establish Exit goals

<> Evaluate Exit readiness

<> Propose Exit options

<> Provide analysis about business value for Exit options

<> Execute an Exit plan

Merger & Acquisitions

A CFO helps business owners identify and target potential companies for an acquisition or merger. According to the Bank of America Merrill Lynch 2016 CFO Outlook, nearly a quarter (23 percent) of middle market companies plan to consider M&A as part of their strategic initiatives this year. CFOs can fill a critical role in the success of these initiatives by being a strategic growth advisor to the CEO. For companies who are selling, raising capital or acquiring smaller businesses for growth, the CFO plays a vital role at every stage in the deal process.

<> Oversee merger/acquisition transition

<> Help integrate multiple accounting departments

<> Establish/integrate accounting systems

<> Evaluate and document existing procedures

<> Interview and assess key financial staff

<> Perform due diligence on a potential M&A company to ensure the integrity of its valuation

<> Create a comprehensive integration plan ready for execution when a deal closes

The most effective CFOs have the ability to build consensus, anticipate change, and manage surprises. As a problem solver with an innate desire to learn, they understand what initiatives are needed to help the organization move forward within its strategic vision. They build and nurture productive relationships inside and outside of a company, act with integrity and transparency. A CFO attends to the future of the business and thinks strategically about the company’s future growth and prosperity.

If you’re in need of CFO services, we can help. Contact us today for a free consultation.

*Sourced from CFO’s perspective, 6/2017

Categories

- Alternative Workforce (2)

- CFO and Accounting Services (2)

- Coworking (1)

- Inspiration (2)

- Payroll (1)